Desde la infancia hasta la jubilación, y en cada paso intermedio, te acompañamos con servicios integrales y una cobertura personalizada, diseñada para adaptarse a tus necesidades en constante evolución.

¡Contáctanos AQUÍ!

Desde la infancia hasta la jubilación, y en cada paso intermedio, te acompañamos con servicios integrales y una cobertura personalizada, diseñada para adaptarse a tus necesidades en constante evolución.

¡Contáctanos AQUÍ!

Desde la infancia hasta la jubilación, y en cada paso intermedio, te acompañamos con servicios integrales y una cobertura personalizada, diseñada para adaptarse a tus necesidades en constante evolución.

¡Contáctanos ahora!

Desde la infancia hasta la jubilación, y en cada paso intermedio, te acompañamos con servicios integrales y una cobertura personalizada, diseñada para adaptarse a tus necesidades en constante evolución.

¡Contáctanos AQUÍ!

Desde la infancia hasta la jubilación, y en cada paso intermedio, te acompañamos con servicios integrales y una cobertura personalizada, diseñada para adaptarse a tus necesidades en constante evolución.

¡Contáctanos AQUÍ!¿Por qué elegir HELPEN?

Elegir una compañía de seguros de salud y vida liderada por un Veterano de EE. UU. significa asociarse con un negocio que comprende la importancia del servicio, la dedicación y la confiabilidad. Los Veteranos aportan una perspectiva única, habiendo sido entrenados para proteger y servir a los demás, a menudo en circunstancias desafiantes. Estos valores se reflejan en cada aspecto de nuestro negocio, garantizando que nuestros clientes reciban el más alto nivel de compromiso, integridad y cuidado.

En Helpen priorizamos la transparencia, el respeto y un fuerte sentido del deber. Nuestra misión va más allá de simplemente ofrecer planes de seguros; estamos comprometidos con asegurarnos de que cada individuo y familia reciba la cobertura que necesita para proteger su salud y su futuro. Entendemos el valor de proteger lo que más importa y nos dedicamos a brindar un apoyo personalizado en cada paso del camino. Con un Veterano de EE. UU. al frente de la compañía, puedes confiar en que tu bienestar está en manos expertas y en que lucharemos por ofrecerte las mejores opciones posibles para ti y tus seres queridos.

Seguro de vida

Seguro de vidaDirecteur des ventes

✅ Seguridad financiera para seres queridos – Proporciona una red de seguridad para los familiares en caso del fallecimiento del titular de la póliza.

✅ Cubre los costos de funeral y entierro – Ayuda a aliviar la carga financiera de los gastos finales.

✅ Reemplazo de ingresos – Garantiza que los dependientes puedan mantener su nivel de vida tras la pérdida del sostén de la familia.

✅ Paga sus deudas – Se puede utilizar para cubrir hipotecas, préstamos o deudas de tarjetas de crédito.

✅ Fondo de educación para niños – Ayuda a asegurar los gastos de educación futura de un niño.

✅ Planificación patrimonial – Facilita la transferencia de patrimonio y puede ayudar a evitar complicaciones financieras.

✅ Beneficios fiscales – Los ingresos del seguro de vida suelen estar libres de impuestos para los beneficiarios.

✅ Crecimiento del valor en efectivo (para pólizas permanentes) – Algunas pólizas acumulan valor en efectivo que se puede tomar prestado.

✅ Tranquilidad – Reduce el estrés al saber que los seres queridos están protegidos financieramente.

✅ El seguro de vida a término puede ser una forma rentable de garantizar protección financiera.

✅ Las pólizas de vida entera actúan como un plan de ahorro forzado con acumulación de valor en efectivo.

✅ Los beneficiarios pueden usar el pago para cualquier necesidad financiera, ofreciéndoles máxima flexibilidad.

Planes funerarios

Planes funerariosDirecteur des ventes

✅ Edades: 0-85 años con protección de seguro de vida entera de hasta $30,000.

✅ No se requiere examen médico.

✅ No es necesario tener un número de seguro social.

✅ Planes flexibles para ajustarse a tu presupuesto

✅ Cobertura inmediata, accidental, mundial.

✅ Los reclamos se pagan dentro de las 24 horas posteriores a la recepción de la documentación necesaria.

✅ Si falleces por accidente, tu beneficiario recibirá INDEMNIZACIÓN DOBLE.

✅ La indemnización está LIBRE DE IMPUESTOS.

✅ Las primas nunca aumentan y los beneficios nunca disminuyen.

✅ Examen auditivo anual y exámenes en tiempo real con proveedores médicos en línea 24/7/365

✅ Apoyo y negociación de procedimientos funerarios para la familia.

✅ Cobertura de gastos finales simple y sin complicaciones.

Plan de inversiones

Plan de inversionesDirecteur des ventes

✅ Haz crecer tu riqueza a través de inversiones inteligentes y ahorros.

✅ Minimiza el riesgo al diversificar las inversiones en diferentes activos.

✅ Crea múltiples fuentes de ingresos para el crecimiento financiero a largo plazo.

✅ Las inversiones como IRAs y 401(k)s crecen sin ser gravadas hasta el retiro.

✅ Las contribuciones a las cuentas de jubilación pueden ser deducibles de impuestos, reduciendo el ingreso gravable.

✅ Las inversiones a largo plazo son gravadas a tasas más bajas sobre las ganancias de capital en comparación con las inversiones a corto plazo.

✅ Diversificar las inversiones en diferentes activos minimiza el impacto de la volatilidad del mercado.

✅ Los portafolios diversificados tienen el potencial de un crecimiento más estable y consistente.

✅ Te ayuda a capitalizar oportunidades en diferentes sectores e industrias.

✅ Las inversiones ayudan a hacer crecer tu riqueza con el tiempo, asegurando un futuro financiero estable.

✅ Las inversiones, especialmente en acciones e inmuebles, pueden superar la inflación y preservar el poder adquisitivo.

✅ Las inversiones inteligentes proporcionan un flujo de ingresos confiable para apoyar tu estilo de vida en la jubilación.

Medicare

MedicareDirecteur des ventes

✅ La Parte A de Medicare cubre hospitalizaciones, cuidados en centros de enfermería especializada y ciertos servicios de salud a domicilio.

✅ La mayoría de las personas no pagan una prima por la Parte A si han trabajado y pagado impuestos de Medicare durante al menos 10 años.

✅ Aunque la mayoría no paga prima, la Parte A requiere deducibles y copagos para ciertos servicios.

✅La Parte B de Medicare cubre visitas al médico, servicios ambulatorios, atención preventiva y algunos servicios de salud en el hogar.

✅ La Parte B requiere una prima mensual, que puede variar según los ingresos.

✅ La Parte B tiene un deducible y normalmente requiere un 20% de coseguro para la mayoría de los servicios cubiertos.

✅La Parte C combina la cobertura de las Partes A y B, a menudo incluyendo beneficios adicionales como visión, dentales y medicamentos recetados.

✅ Ofrecida a través de aseguradoras privadas aprobadas por Medicare, la Parte C puede tener costos y opciones de cobertura diferentes.

✅ Los planes de la Parte C pueden ofrecer beneficios adicionales como programas de bienestar y costos reducidos de bolsillo.

✅ La Parte D de Medicare ayuda a cubrir el costo de los medicamentos recetados.

✅ Los planes de la Parte D son proporcionados por compañías de seguros privadas aprobadas por Medicare.

✅ La Parte D requiere una prima mensual, y los costos pueden variar dependiendo del plan y los medicamentos.

Seguro de salud / Obamacare

Seguro de salud / ObamacareDirecteur des ventes

✅La Ley de Cuidado de Salud a Bajo Precio (ACA) tiene como objetivo proporcionar seguro de salud accesible para todos, independientemente de las condiciones preexistentes.

✅ Creó un mercado donde las personas y familias pueden comparar y comprar planes de seguro de salud, a menudo con subsidios.

✅ La ACA exige que los planes de seguro cubran servicios preventivos, como vacunas y exámenes, sin costo adicional.

✅A través del Mercado Federal, puedes calificar para subsidios como créditos fiscales para primas y reducciones de costos compartidos que hacen que tu cobertura sea más asequible.

✅ Elige entre una variedad de planes que se ajusten a tus necesidades, ya sea que necesites una cobertura básica o un plan con beneficios más completos.

✅ Los planes de seguro de salud a través del Mercado Federal no pueden negar la cobertura ni cobrar primas más altas basadas en condiciones preexistentes.

✅ Todos los planes del Mercado deben cubrir servicios clave de salud, incluidos cuidados preventivos, servicios de emergencia, atención materna y de recién nacidos, servicios de salud mental y más.

✅Créditos fiscales para primas: Estos créditos reducen el costo de tus primas mensuales, haciendo que el seguro de salud sea más asequible.

✅ Reducciones de costos compartidos: Si calificas para un plan plata, las reducciones de costos compartidos pueden disminuir tus gastos de bolsillo, como deducibles, copagos y coseguro.

✅ Medicaid: Si cumples con los requisitos de ingresos, puedes calificar para Medicaid, que ofrece cobertura de salud gratuita o de bajo costo para individuos y familias elegibles.

✅El Período de Inscripción Abierta es tu oportunidad anual para aplicar, renovar o cambiar tu plan de seguro de salud. Las fechas varían, ¡así que asegúrate de marcar tu calendario! Puedes inscribirte en un plan del Mercado incluso sin un evento de vida calificante.

✅ Puedes calificar para un Período de Inscripción Especial si experimentas ciertos eventos de vida, tales como:

Georgia Access

Georgia AccessDirecteur des ventes

✅Mercado Estatal – Georgia Access es una plataforma gestionada por el estado para ayudar a los residentes a encontrar e inscribirse en planes de seguro de salud.

✅ Opciones de cobertura asequibles – Ofrece una variedad de planes, a menudo con asistencia financiera para individuos y familias elegibles.

✅ Ayuda personalizada para la inscripción – Proporciona recursos y apoyo para guiar a los residentes en el proceso de selección de seguros.

✅Orientación experta – Los agentes certificados ayudan a individuos y familias a elegir el plan de salud adecuado de Georgia Access.

✅ Asistencia gratuita – Sus servicios no tienen costo adicional, lo que facilita la navegación de las opciones de seguro de salud.

✅ Licenciados y capacitados – Los agentes están certificados por Georgia Access para proporcionar apoyo preciso y confiable en el proceso de inscripción.

✅El Período de Inscripción Abierta es tu oportunidad anual para aplicar, renovar o cambiar tu plan de seguro de salud. Las fechas varían, ¡así que asegúrate de marcar tu calendario! Puedes inscribirte en un plan del Mercado incluso sin un evento de vida calificante.

✅ Puedes calificar para un Período de Inscripción Especial si experimentas ciertos eventos de vida, tales como:

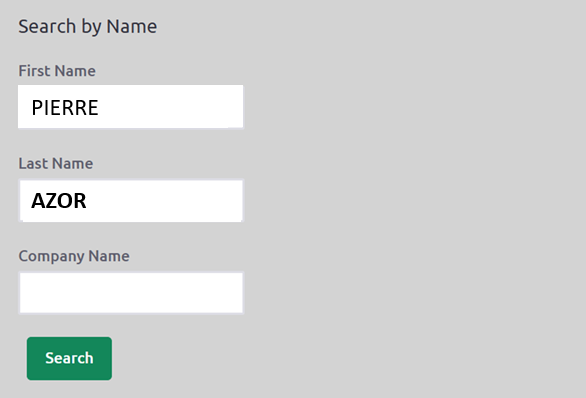

Buscar Agente Certificado Pierre Azor (Deja el nombre de la empresa en blanco)

Planes de retiro

Planes de retiroDirecteur des ventes

✅ La jubilación puede parecer lejana, pero planificar ahora asegura la seguridad financiera más adelante. No importa en qué etapa de tu carrera te encuentres, nunca es demasiado temprano para comenzar a prepararte.

✅ La planificación de la jubilación va más allá de ahorrar, se trata de crear un estilo de vida que disfrutarás, considerando los gastos y los costos de salud.

✅ Comenzar temprano te permite aprovechar el crecimiento compuesto, aumentando tus posibilidades de una jubilación cómoda y sin estrés.

✅Plan 401(k) – Plan patrocinado por el empleador que permite contribuciones antes de impuestos, a menudo con aportaciones del empleador.

✅ IRA Tradicional – Cuenta individual de jubilación con impuestos diferidos y contribuciones deducibles (sujetas a límites de ingresos).

✅ IRA Roth – Cuenta individual de jubilación, financiada con ingresos después de impuestos, que ofrece retiros libres de impuestos al jubilarse.

✅ Plan 403(b) – Similar al 401(k), pero diseñado para empleados de organizaciones sin fines de lucro, escuelas y ciertos trabajos del sector público.

✅ SEP IRA – Plan simplificado para autónomos y propietarios de pequeñas empresas con altos límites de contribución.

✅ SIMPLE IRA – Plan de jubilación para pequeñas empresas con contribuciones del empleador y una administración más sencilla.

✅ Planes de pensión – Planes gestionados por el empleador que proporcionan ingresos garantizados en la jubilación, aunque hoy en día son menos comunes.

✅ Anualidades – Planes de jubilación basados en seguros que ofrecen ingresos garantizados, ya sea inmediatos o diferidos.

✅

Una de las preguntas más grandes sobre la jubilación es: ¿cuánto necesito ahorrar? La respuesta depende de una variedad de factores, que incluyen:

✅ Una regla común es ahorrar el 15% de tus ingresos antes de impuestos cada año. Sin embargo, es importante personalizar tu plan de jubilación a tu situación única. Un asesor financiero puede ayudarte a determinar una cantidad objetivo de ahorro y a crear una estrategia para alcanzarla.

Beneficios fiscales – Los ingresos del seguro de vida generalmente están libres de impuestos para los beneficiarios.

✅ Crecimiento del valor en efectivo (para pólizas permanentes) – Algunas pólizas acumulan valor en efectivo que se puede tomar prestado.

✅ Tranquilidad – Reduce el estrés al saber que tus seres queridos están protegidos financieramente.

Seguro Suplementario

Seguro SuplementarioDirecteur des ventes

✅El seguro de salud suplementario es exactamente eso: proporciona ayuda o complementa un plan de salud ofreciendo beneficios adicionales que pueden ayudar a cubrir gastos de bolsillo como deducibles, coseguros, copagos o incluso productos de cuidado dental o la vista de rutina. Porque lo más probable es que su plan de seguro médico no cubra todo. Completar su cobertura con planes suplementarios puede ayudarle a protegerse contra costos inesperados.

✅Complementar su cobertura con planes suplementarios significa que tendrá ayuda para pagar los costos de bolsillo no cubiertos por su plan médico regular.

✅Elegir planes con beneficios en efectivo que pagan una suma global puede brindarle tranquilidad al saber que está protegido si ocurre un evento médico inesperado, como una enfermedad crítica o un accidente.

✅ Con una variedad de planes suplementarios disponibles, puede elegir la cobertura que se adapte a su edad, familia y situación, para que tenga la protección adecuada para su vida.

Seguro dental y de visión

Seguro dental y de visiónDirecteur des ventes

✅ Menores gastos de bolsillo – Reduce los costos de exámenes de rutina, limpiezas y lentes correctivos.

✅ Descuentos en procedimientos mayores – Cubre parte de los gastos de empastes, coronas, aparatos dentales y cirugías.

✅ Cobertura de atención preventiva – Fomenta los chequeos regulares, previniendo problemas de salud costosos.

✅ Primas asequibles – Generalmente son más bajas que pagar por los servicios de forma individual.

✅ Detección temprana de problemas de salud – Los exámenes dentales y de la vista de rutina pueden identificar condiciones graves como diabetes y presión arterial alta.

✅ Mejor salud bucal – Reduce el riesgo de enfermedades en las encías, caries e infecciones que pueden afectar el bienestar general.

✅ Protección de la vista – Ayuda a detectar problemas de visión a tiempo, previniendo daños oculares a largo plazo.

✅ Apoya el bienestar a largo plazo – Fomenta el cuidado proactivo, llevando a una vida más saludable.

✅ Visión clara para las actividades diarias – Asegura una buena visión para el trabajo, conducir y leer.

✅ Confianza en tu sonrisa – Apoya la estética dental y la función para mejorar la autoestima.

✅ Reducción del estrés por costos médicos – Proporciona tranquilidad con protección financiera para gastos inesperados.

✅ Mejor productividad – Una buena salud visual y bucal contribuye a una mayor concentración y rendimiento laboral.

✅ Amplias redes de proveedores – Acceso a muchos dentistas y oftalmólogos.

✅ Opciones de planes flexibles – Elige planes que se ajusten a las necesidades individuales o familiares.

✅ Proceso de reclamaciones sencillo – Reembolsos sin complicaciones y opciones de facturación directa.

✅ Cobertura para familias – Los planes a menudo incluyen al cónyuge y a los hijos para una atención integral.

APRENDER

Navegar por el seguro médico puede ser complicado si no estás familiarizado con los detalles, pero encontrar la cobertura adecuada para protegerte a ti y a tu familia es esencial. Ahí es donde entramos nosotros. En HELPEN, nuestro equipo está aquí para guiarte en cada paso del camino. Haz equipo con nosotros y te ayudaremos a asegurar la cobertura que necesitas para proteger tu salud, a tus seres queridos y tus bienes con confianza.

COMPARAR

Elegir el plan de seguro adecuado puede ser más complicado de lo que parece, con numerosas opciones de cobertura disponibles, muchas de las cuales pueden no alinearse con tus necesidades específicas. En HELPEN, nos comprometemos a asegurarnos de que nunca te falte la cobertura que mereces. Por eso ofrecemos nuestra herramienta fácil de usar, PlanPrescriber, diseñada para ayudarte a comparar planes e identificar el que mejor se adapta a tu situación.

INSCRIBIRSE

¿Listo para experimentar la tranquilidad que brinda un plan de seguro de salud integral? ¡Inscríbete con HELPEN hoy mismo! Hacemos que el proceso sea sencillo, ofreciendo herramientas para rastrear tu solicitud, recibir actualizaciones de tu plan y mucho más. ¡No esperes más, llámanos ahora para comenzar!

¡Envíanos un correo aquí!

El contador de satisfacción

Cliente satisfecho

Calificado

Años de experiencia combinada